Income minus costs equals profit. Easy, right? It’s almost imposible to make a mistake.

But, did you know that around 30% of e-commerce do this calculation wrong? What if I tell you that almost half of e-commerce change the price of the products without knowing their operating margin?

And what if I tell you that you might be losing money without knowing it?

To err is human, and we wondered how many of our customers have doubts when calculating their operating margin. We observed and we discovered that 40% did not know thay were making a mistake. The surprise looks on their faces were incredible while boardfy showed them that they were losing money.

That’s why we want to give you a piece of advice, so that you won’t make the same mistakes we did.

The trap

Operating margin means the difference between the retail price (taxes not included) and costs (production, acquisition, delivery, management…)

As you can see, it is not a complex calculation even though the equation could turn into a more difficult operation depending on its variables.

How to calculate the margin: the trap inside the formula

One of the e-commerce most common mistakes is how to calculate their operating margin. And when you find out you wonder how did you get here alive without noticing it.

For example, we have a product which cost is €100, and we want to have a 30% benefit. Which should be the selling price? If you think that €130 is the answer, then you are wrong.

We will continue with this example to prove why it shouldn’t be done like this. Imagine you want to have a 25% discount on the same product for a couple of days. At first, it seems clear that if we had a 30% profit and we discount a 25% we will still have a 5% profit, right? Let’s do the math.

Selling price is €130. 25% of 130 equals €32,5.

Then the offer price is: 130-32,5= €97,5.

Remember that the product cost is €100. We are now losing €2,5 with each product we sell.

The mistake is to calculate the operating margin taking as a starting point the cost (€100), while the discounts are applied over the selling price (€130). The margin is not calculated from the cost price but from the selling price.

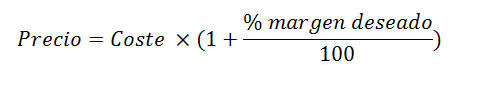

This is the formula used for this example:

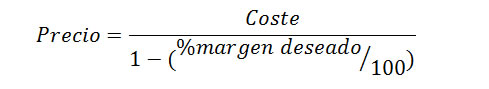

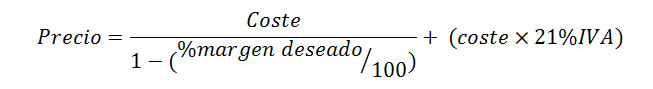

And this is the formula we should really use:

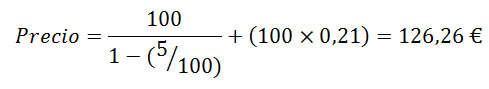

If we use this last formula with the example, then the price will be the following:

We now apply the 25% discount et voilá!, we have an offer price of €107,15 and a positive margin of €7,15.

Miscalculations: VAT

We have also found mistakes in the calculation of the value-added tax. Besides, this mistake is difficult to detect because its effect is not noticed until you have to pay the taxes, some time after the product is sold.

VAT, also known as goods and services tax (GST), is a general consumption tax that increments the prices of the goods and services offered by companies and professionals.

The problem starts then the VAT percentage (21% in Spain) is calculated by companies and professionals to establish their prices.

In Boardfy, we have detected that some of our customers were losing money in a large part of their products. After we looked over the different formulas they were using to establish their selling prices, we realised that some of them used the following:

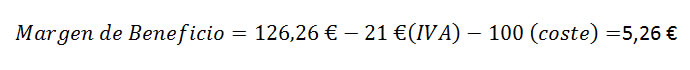

Instead of a 30% profit, we will choose a 5% this time to be more competitive. If we maintain the rest of the values from the previous example, the selling price would be:

So far so good: we have included the taxes in the selling price, so that the margin left will remain the same, right?

The actual margin we earn with this VAT formula is:

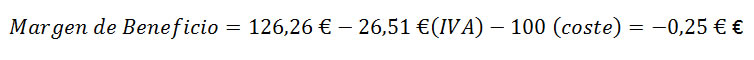

After three months of selling products, we will have to pay our taxes. And that’s when we find out that there’s something wrong: at the moment when the tax office tells us that we hat to pay a €26,51 tax for each product of this value.

And that’s the very moment when we are left with our mouths open, because the real operating margin for that product is the following:

We have gone from earning €5,26 to losing €0,25 for each product sold… During the last three months.

We can find the solution to this problem in the VAT definition:

“VAT is a tax paid accordingly to the value we add to those products we have acquired. This is, it is calculated according to the retail price”.

Our mistake was to calculate VAT according to our cost instead of according to the selling price (cost + expected profit).

Uncontrolled price reductions

As a price intelligence software, we firmly believe that e-commerce businesses need to have a pricing strategy as a way to beat the competitors and to improve the sales.

The problem appears when we reduce our prices constantly without keeping in mind other elements apart from the selling price of our competitors.

Since we introduced in Boardfy the cost integration, some of our clients have observed astonished the actual operating margin they were working with after all the price reductions. They didn’t consider the cost of each product and reduced their prices without any control.

The result was that many of them were losing money with each sale in a large amount of their products.

The bright side is that they started to plan a pricing intelligence strategy according to their operating margin of each product after this discovery. That allowed them to reduce and prevent economic losses.

Here you have the major mistakes e-commerce businesses make in relation to their margins. As you can see, it is easier than it seems to lose money with your products, so we encourage you to check your costs, taxes and margins, as well as the profits you earn for each product with Boardfy.